CRE Investing Fundamentals: Cap Rates

This is part two of a three-part series on commercial real estate fundamentals. This series covers NOI, cap rates, and the capital stack. Part one discussed NOI and it is available to all subscribers.

As noted in part of one of this series, CRE values are driven by two primary factors: net operating income (NOI) and capitalization rates (cap rates). If you haven’t already, please read the post on NOI. Let’s jump into the cap rate discussion.

What is a cap rate?

The technical definition of a cap rate is as follows:

NOI / Property Value = Cap Rate

/ = divided by

A cap rate expresses an investor’s potential unlevered return on a CRE investment. Unlevered means no debt is involved. While debt is often used in CRE investments, we want to compare the potential unlevered return across the universe of investment opportunities.

Cap Rate Example:

An office building’s NOI is $1,000,000. The property owner receives a purchase offer for $12,000,000. What cap rate is the Buyer offering to pay?

$1,000,000 / $12,000,000 = 8.33%

The Buyer expects an 8.33% operating cash yield in Year 1. Remember, NOI includes just operating expenses. If the property incurs capital expenses in Year 1, the actual cash yield will be lower.

Cash Yield = Annual Cash Flow / Total Equity

Going back to our example above, let’s say the Buyer incurred $150,000 in capital expenses in Year 1. The actual cash available for distribution is $850,000 ($1,000,000 minus $150,000). Let’s assume the Buyer paid all cash (100% equity) for the property. The Year 1 cash yield is:

$850,000 / $12,000,000 = 7.08%

So why use the cap rate instead of the cash yield? The reality is that investors will evaluate both. The cap rate facilitates more of an “apples-to-apples” comparison. Two reasons: 1) capital expenditures tend to be discretionary. Two people can look at the same issue and come to vastly different conclusions on how soon it needs to be addressed. 2) financing costs depend on the capital structure and the cost of capital.

The big picture is that deal pricing is quoted using cap rates, not cash yields. Cap rates give us some uniformity when comparing the potential returns among asset classes.

How is a cap rate used?

A cap rate is typically used as an input to estimate a property’s value and/or potential selling price. If you rearrange the equation, you get the following:

NOI / Cap Rate = Property Value

Landlords know their property’s NOI. However, the cap rate is much more subjective, and minor changes can significantly impact valuation. Cap rates also change as market conditions change. They are not static. So how can we determine an appropriate cap rate?

Comparable Sales

Recent transactions of similar properties will provide insight into how the market values your property.

Local sales brokers are your best source of information. They talk to buyers and sellers of CRE every day. They can discuss recent transactions and provide key insights into how buyers price a deal.

Data services

CoStar and Crexi are the most popular. They try to provide the cap rate on every transaction they track.

However, 1) it is not always available as the Buyer or Seller has to provide the NOI, and 2) no two properties are the same, so quantitative and qualitative factors may have influenced the cap rate. Nonetheless, they obtain enough information to issue market reports, including the average cap rate for different property types within different markets.

Investor Surveys

National brokerages such as CBRE, JLL, Marcus & Millichap, and Cushman & Wakefield typically release a cap rate survey. It can be quarterly, bi-annually, or annually.

This is a good starting point to understand investor sentiment and pricing expectations at the macro level.

You still must analyze the micro level as local sales comps are more important than the aggregated national data.

Most of this information is free on the company’s corporate website. If you are serious about CRE, take the time to read it.

Example:

The above chart is from CBRE’s H1 2023 Cap Rate Survey.

The survey was conducted in May/June 2023. Interest rates started to rise sharply in 2022. Cap rates followed.

What is driving the cap rate?

We could spend an entire day discussing and debating the factors which drive cap rates. I’m going to touch on the main factors.

Interest Rates

The cost of debt financing has a direct impact on cap rates. The vast majority of CRE is purchased using debt (i.e., the Buyer takes out a loan collateralized by the real estate). As interest rates rise, so does the cost to service that debt. Here is an example:

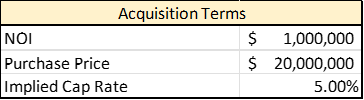

We agree to purchase a property with $1,000,000 of NOI for $20,000,0000. This implies we are paying a 5 cap for the property. Before agreeing to the purchase price, we discussed the deal with our lender, and they quoted the following terms:

Take note of the following:

The interest rate on our loan is < the implied cap rate (4.50% < 5%).

The debt service coverage is > 1. In this case, our NOI of $1,000,000 can easily cover the annual interest payment of $638,750. We could lose tenants and not be stressed about making our loan payment.

The cash yield > implied cap rate. Remember, if we purchase the property with cash, we expect a 5% return. By adding debt, we’ve enhanced our return to 6%.

What happens if the interest rate rises to 6.50%?

The interest rate on our loan is > the implied cap rate (6.50% > 5%).

The debt service coverage is just over 1. In this case, our NOI of $1,000,000 can barely cover the annual interest payment of $922,639. If we lose a single tenant, we could be in trouble. Plus, we haven’t even considered capital expenses.

The cash yield < implied cap rate. We’re barely earning a nominal return at 1.29%.

A lender wouldn’t finance this deal under these terms. They would lower the LTV, reduce the annual interest payment, and increase the debt service coverage. However, that would require you to bring significantly more equity (cash).

Even if the lender would do the deal, are your equity investors going to like earning a projected 1.29% yield? Of course, not. The deal doesn’t work.

Note that I am using an interest-only payment to calculate the debt service. Lenders would use the fully amortized payment to calculate it.

Now, if we purchase this deal with 100% cash, then the cost of debt is irrelevant. We are earning 5% unlevered. However, can I find a safer investment and still make 5%? What if the 10-year treasury yield is at 4.75%? Is 0.25% of additional yield adequate compensation for the additional risk? Individual investors have to make that decision. In aggregate, the market tends to be good at answering that question.

Rent Growth

If there is an opportunity to drive rent growth at a property, investors can afford to pay a lower “going-in” cap rate (i.e., the year 1 cap rate based on in-place revenue). Think about multifamily properties with 1-year leases. If we believe apartment rents are 40% below market, we can raise everyone’s rent within 12 months of our acquisition. The additional $400,000 in revenue essentially increases NOI by $400,000.

We are still willing to pay $20,000,000 for the property because there is a substantial rent growth opportunity. Investors’ expectations of rent growth (or expense reduction) over their desired holding period significantly impact how they price deals.

Asset Class

Certain property types are considered safer investments and command lower cap rates. Investors have to be compensated for the additional risk. All else equal, would you rather own a multifamily property or an office property today? We feel confident that people will need a place to live. Everyone needs a roof over their head. We are not sure companies will need office space, at least not as much as before, due to the work-from-home trend.

Think about shopping mall properties versus industrial distribution properties. Consumers have shifted their preference to e-commerce. When was the last time you were in a mall? When was the last time Amazon delivered a package to your front door? Based on those answers, which is more likely to keep paying their rent: the e-commerce tenant(s) at the distribution center or the shopping mall tenants?

Location

The better the location, the lower the cap rate. The best locations will garner significant tenant demand. If you lose a tenant, you can replace them easily. If their lease is due to expire, you can more easily command a higher rent. Would you rather own a multifamily high-rise in New York City (NYC) or a multifamily low-rise in rural Oklahoma? All else equal, you better purchase the Oklahoma property at a much higher cap rate.

Cap Rate Sensitivity

As mentioned previously, minor changes in the cap rate can significantly impact valuation. Let’s come back to the office building with $1,000,000 in NOI. Here is what the valuation looks like at various cap rates:

A few observations from this matrix:

As the cap rates increase, the property value decreases.

If you’re familiar with fixed-income valuation, it’s the same concept as rising bond yields = falling bond prices.

Very important concept to understand.

Cap rates and property values have convexity. As the matrix below shows, the lower the starting point for the cap rate, the more dramatic the change.

This is critical for all CRE investors, especially those in certain asset classes.

The following is a real-world example of cap sensitivity.

A couple of years ago, I was part of an investment team that acquired a distressed property in a great location. We demolished the existing building and marketed the site as a redevelopment opportunity. We eventually executed a ground lease with 7-11. The basic terms of the ground lease were 7-11 would pay us $300,000 annually and cover all operating expenses (i.e., a net lease) for 20 years. They would construct and pay for their building and gas station.

Before construction could begin, the site had to be entitled and approved by the City and County. We will cover development in depth, but for now, know this is a slow process. By December 2021, we were close enough to the rent commencement date that we could begin the sales process. At this time, the 20-year treasury yield was approximately (~) 2%. Our sales broker advised us to go to market with a 4% asking cap or $7,500,000 (NOI =$300,000 / 4%). I am using the 20-year treasury yield since it has the same duration as the ground lease.

An investor eventually agreed to our asking price, and we were able to sign the Purchase and Sale Agreement (PSA). The PSA gave the Buyer 30 days of due diligence and then 30 days to close. During the due diligence period, the Buyer could terminate the PSA, without penalty, for any reason. This is typical. Unfortunately, treasury yields started to rise rapidly. Three weeks after the PSA was signed, yields had climbed to ~2.75%. This caused much uncertainty among investors, including our Buyer, who decided to terminate the deal.

20-Year Treasury Yield

As I mentioned earlier, investors compare potential returns across asset classes. Treasury yields are considered risk-free assets. The US government guarantees the payment of interest and the repayment of principal. There is virtually no default risk. An investor buying a 7-11 ground lease has to be compensated for the risk they stop paying rent. There is credit risk with 7-11.

So now we have to go back out to market. Our broker engages with all the parties who previously made an offer. No one is close to 4%. The best offer was a 4.25% cap or ~$7,050,000 purchase price. Ouch! A 0.25% increase to the cap rate cost us ~$450,000. This Buyer eventually dropped the deal, and we were forced to accept a 4.50% cap rate or ~$6,670,000 purchase price from another Buyer. $830,000 less than we originally expected.

Given the valuation sensitivity to cap rates, CRE investors should always use a range to evaluate the potential outcomes.

That's a wrap for cap rates. Next week, we will cover the capital stack. Please let me know if you have any questions.